Sinking funds for big expenses sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of smart financial planning with sinking funds, where you’ll learn how to prepare for those major expenses that life throws your way.

Importance of Sinking Funds: Sinking Funds For Big Expenses

Sinking funds are key players in the financial game, helping you stay ahead of the curve when it comes to those big expenses that sneak up on you. They are like a separate savings account dedicated to specific future expenses, allowing you to plan and save gradually over time.

Covering Big Expenses

- Car Repairs: Sinking funds can save you from the headache of unexpected repairs by setting aside money each month.

- Home Renovations: Planning ahead with sinking funds can make that dream kitchen or bathroom upgrade a reality without breaking the bank.

- Medical Bills: Having a sinking fund for medical expenses can provide peace of mind when faced with unexpected health costs.

Difference from Emergency Funds

Sinking funds are not the same as emergency funds. While emergency funds are for unexpected events like job loss or medical emergencies, sinking funds are specifically earmarked for planned expenses that you know will come up in the future. It’s all about being proactive and prepared for life’s curveballs!

Setting Up Sinking Funds

When it comes to setting up sinking funds for big expenses, there are a few key steps to follow in order to ensure you are adequately prepared for those financial obligations. By planning ahead and saving consistently, you can avoid the stress of unexpected expenses and maintain financial stability.

Calculating the Amount to Save, Sinking funds for big expenses

- Determine the total cost of the big expense you are saving for. This could be anything from a new car to a home renovation project.

- Decide on a timeline for when you will need the funds. This will help you calculate how much you need to save each month to reach your goal.

- Consider any additional factors, such as interest rates or inflation, that may impact the final amount you need to save.

Automating Contributions

- Set up automatic transfers from your checking account to a separate savings account dedicated to your sinking funds. This ensures that you are consistently saving without having to think about it.

- Consider increasing your contributions whenever you receive a windfall, such as a bonus or tax refund. This can help you reach your savings goal faster.

- Regularly review your sinking funds and adjust your contributions as needed based on changes in your financial situation or the cost of the expense you are saving for.

Types of Big Expenses to Save For

Saving for big expenses through sinking funds is essential to ensure financial stability and preparedness for unexpected costs. Tailoring sinking funds to individual financial goals and circumstances is crucial for effective planning and budgeting. Let’s explore common big expenses individuals should consider saving for and how sinking funds can help in both long-term and short-term scenarios.

Home Repairs and Maintenance

- Roof repairs

- Plumbing issues

- HVAC system maintenance

Car Repairs and Replacement

- Engine repairs

- New tires

- Vehicle upgrades

Medical Emergencies

- Unexpected hospital bills

- Surgery costs

- Prescription medications

Education and Career Development

- Tuition fees

- Professional certification courses

- Job-related conferences or workshops

Managing Sinking Funds

Managing sinking funds effectively is crucial for ensuring you have the necessary funds when big expenses arise. Here are some tips to help you track and manage your sinking funds efficiently.

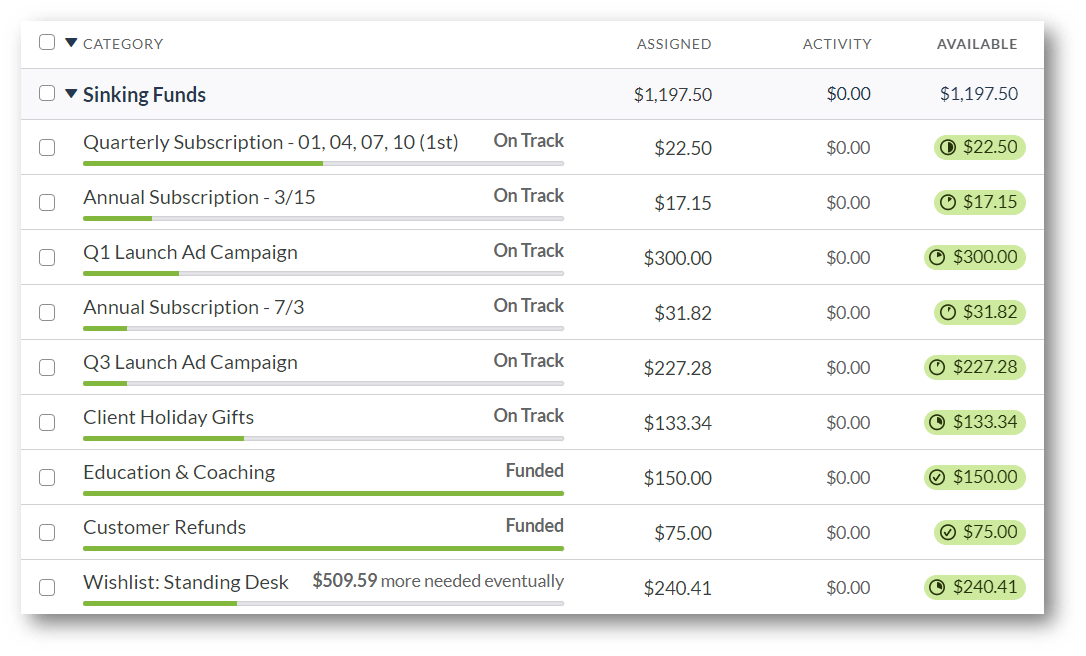

Tracking Sinking Funds

- Regularly update your sinking fund balances to keep track of how much you have saved for each expense.

- Use a spreadsheet or budgeting app to monitor your sinking funds and contributions easily.

- Label each sinking fund clearly to avoid confusion and ensure you allocate the right amount to each expense.

Challenges in Maintaining Sinking Funds

- One common challenge is the temptation to dip into your sinking funds for non-essential purchases. To overcome this, remind yourself of the purpose of each fund and stick to your savings plan.

- Unexpected financial emergencies may arise, causing you to consider using your sinking funds for other purposes. Create an emergency fund to cover these unexpected expenses, so you don’t have to touch your sinking funds.

Adjusting Sinking Fund Contributions

- Assess your financial situation regularly and adjust your sinking fund contributions accordingly. If you have extra income or reduced expenses, consider increasing your contributions to reach your savings goals faster.

- If you encounter financial setbacks or unexpected expenses, temporarily reduce your sinking fund contributions but aim to resume regular contributions as soon as possible.