Passive Income Ideas sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Imagine a world where your money works for you while you sleep. That’s the power of passive income, and in this guide, we’ll explore various ways to generate it, from real estate to online businesses, and more. Get ready to seize your financial future!

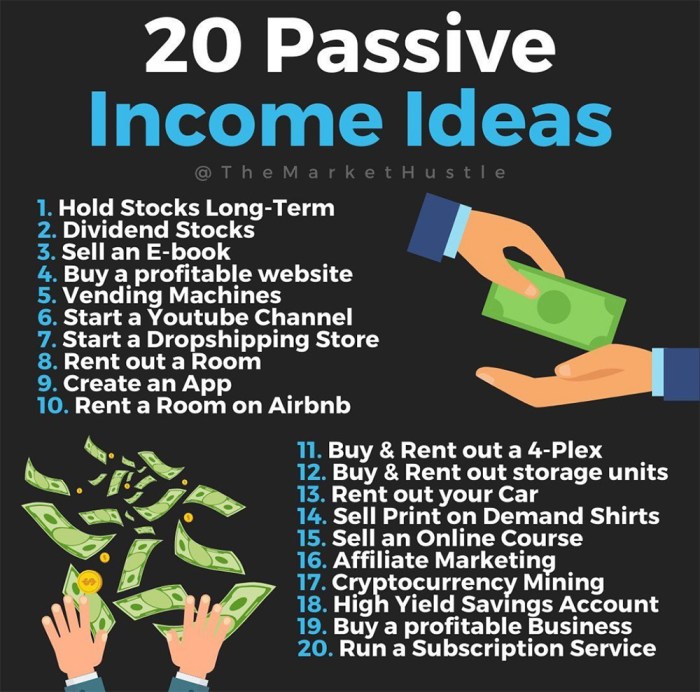

Introduction to Passive Income Ideas

Passive income refers to earnings that are generated with minimal effort or active involvement on a regular basis. It is crucial in financial planning as it provides a steady stream of income without the need for constant time and effort investment. This type of income allows individuals to build wealth and achieve financial independence over time.

Examples of Popular Passive Income Streams

- Dividend-paying stocks: Investing in stocks that pay dividends regularly can provide a source of passive income.

- Rental properties: Owning real estate and renting it out to tenants can generate passive income through rental payments.

- Interest from savings accounts or bonds: Money put into savings accounts or invested in bonds can earn interest passively.

- Creating digital products: Developing and selling digital products like e-books or online courses can generate passive income through sales.

Benefits of Having Passive Income

- Diversification of income sources: Passive income streams can provide stability and security by diversifying sources of income.

- Freedom and flexibility: Having passive income allows individuals to have more freedom and flexibility in how they spend their time.

- Building wealth over time: Passive income can help individuals build wealth steadily and work towards financial goals without relying solely on active income.

Real Estate as a Passive Income Idea

Real estate can be a lucrative source of passive income for individuals looking to build wealth over time. By investing in properties, individuals can generate income through rental payments, property appreciation, and other real estate ventures without actively managing the properties on a day-to-day basis.

Ways to Generate Passive Income through Real Estate Investments

- Rental Properties: Investing in rental properties is a popular way to generate passive income in real estate. By renting out properties to tenants, investors can earn a steady stream of income each month.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. Investors can purchase shares in REITs to earn dividends without directly owning physical properties.

- Airbnb Rentals: Renting out properties on platforms like Airbnb can also be a profitable way to generate passive income through real estate. By hosting guests in your property, you can earn income without a long-term rental commitment.

Tips for Beginners Looking to Start Investing in Real Estate for Passive Income

- Do Your Research: Before diving into real estate investing, take the time to research different investment opportunities, property types, and market trends to make informed decisions.

- Start Small: Consider starting with a single rental property or investing in a REIT to gain experience in real estate investing before expanding your portfolio.

- Set Financial Goals: Define your financial goals and objectives for real estate investing, whether it’s generating passive income, building equity, or diversifying your investment portfolio.

- Seek Professional Advice: Consult with real estate agents, financial advisors, or experienced investors to get valuable insights and guidance on the best investment strategies for passive income.

Online Business and E-commerce as Passive Income Ideas

Online business and e-commerce have become popular avenues for generating passive income in today’s digital age. These platforms offer unique opportunities to create a stream of income with minimal effort once set up properly.

Successful Examples of Online Businesses Generating Passive Income, Passive Income Ideas

- Dropshipping: This business model involves selling products without holding inventory. Dropshippers partner with suppliers who handle shipping and logistics, allowing them to earn a profit on each sale without the hassle of managing stock.

- Affiliate Marketing: Affiliate marketers promote products or services and earn a commission for every sale made through their referral link. By creating valuable content and driving traffic to affiliate partners, individuals can earn passive income through commissions.

- Print on Demand: With print-on-demand services, individuals can design custom products like apparel, accessories, and home goods. When customers make a purchase, the product is printed and shipped on demand, eliminating the need for inventory management.

Challenges and Advantages of Running an Online Business for Passive Income

- Advantages:

- Flexibility: Online businesses can be managed from anywhere with an internet connection, allowing individuals to work on their own schedule.

- Scalability: With the ability to reach a global audience, online businesses have the potential for rapid growth and increased revenue.

- Low Overhead Costs: Compared to traditional brick-and-mortar businesses, online ventures often require lower initial investment and operating expenses.

- Challenges:

- Competition: The online marketplace is highly competitive, requiring entrepreneurs to differentiate their products or services to stand out.

- Digital Marketing: Effective online marketing strategies are essential for driving traffic and converting leads into customers, which can be time-consuming and complex.

- Technical Skills: Running an online business may require knowledge of web development, , and other technical aspects to optimize performance.

Investing in Dividend-Paying Stocks as a Passive Income Idea

Investing in dividend-paying stocks can be a great way to generate passive income over time. When you invest in these stocks, you receive a portion of the company’s profits in the form of dividends, which are typically paid out regularly to shareholders. This can provide you with a steady stream of income without requiring active involvement in the day-to-day operations of the company.

Factors to Consider When Selecting Dividend Stocks for Passive Income

- Dividend Yield: Look for stocks with a history of consistent dividend payments and a high dividend yield.

- Dividend Growth: Consider companies that have a track record of increasing their dividends over time.

- Company Stability: Choose stocks from companies with strong financials and a stable business model.

- Industry Trends: Analyze the industry the company operates in to assess its growth potential and sustainability.

Strategies for Building a Dividend Stock Portfolio for Long-Term Passive Income

- Diversification: Spread your investments across different sectors to reduce risk and increase potential returns.

- Reinvest Dividends: Consider reinvesting your dividends to purchase more shares and compound your returns over time.

- Regular Monitoring: Stay updated on the performance of your dividend stocks and make adjustments to your portfolio as needed.

- Long-Term Approach: Focus on building a portfolio of dividend stocks with the intention of holding them for the long term to benefit from compounding growth.

Creating Digital Products as a Passive Income Idea

Creating and selling digital products can be a lucrative way to generate passive income. By investing time and effort upfront to develop these products, you can continue to earn money from them without much ongoing work. Here’s how you can get started and maximize your passive income potential with digital products:

Types of Profitable Digital Products

- E-books: Authoring and selling e-books on various topics can be a great way to earn passive income. Once created, they can be sold repeatedly without additional effort.

- Online Courses: Developing online courses on platforms like Udemy or Teachable can provide a steady stream of passive income from course enrollments.

- Stock Photos: If you have a talent for photography, selling stock photos on platforms like Shutterstock or Adobe Stock can generate passive income every time someone downloads your photos.

Tips for Marketing and Promoting Digital Products

- Utilize Social Media: Leverage platforms like Facebook, Instagram, and Twitter to promote your digital products to a wider audience.

- Email Marketing: Build an email list of potential customers and use email marketing campaigns to drive sales of your digital products.

- Collaborate with Influencers: Partnering with influencers in your niche can help increase visibility and sales of your digital products.

- Offer Discounts and Promotions: Running limited-time promotions or offering discounts can create a sense of urgency and drive sales of your digital products.